south carolina estate tax exemption 2021

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Even though there is no South Carolina estate tax the federal estate taxmight still apply to you.

Estate Tax Exemption 2021 Amount Goes Up Union Bank

For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000.

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

. The start of a new year frequently includes new or updated statutes and South Carolina is no exception. In theory the tax is rather simple to calculate. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent.

According to the South Carolina Department of Revenue the Homestead Exemption relieves you from taxation on the first 50000 in fair market value of your owned legal residence if you are over the age of 65 or you are totally and permanently disabled or you are legally blind. The County Assessor however automatically will apply rollback taxes to any property in which the purchaser has not filed an application to continue an agricultural use special assessment ratio property tax exemption. As defined in Section 58-9-25104 preceding the tax year in which the exemption is claimed and holds complete fee simple title or a life estate to the dwelling place SECTION 2.

RELATING TO THE HOMESTEAD PROPERTY TAX EXEMPTION ALLOWED FOR PERSONS WHO ARE OVER THE AGE OF SIXTY-FIVE YEARS DISABLED OR LEGALLY BLIND. Federal exemption for deaths on or after January 1 2023. 2021 brings an update to South Carolina rollback tax laws with potentially significant.

Currently the exemption is 117 million for calendar year 2021. School and special assessment real estate property taxes when the person. I has been a resident of this State for at least one year and.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. South Carolina has no estate tax for decedents dying on or after January 1 2005. As a result of the pandemic many people have moved to the state away from large cities in the Northeast.

You must have other earned income to claim this deduction. Section 12-37-250 A 1 of the 1976 Code is amended to read. Real Estate taxation is a year in arrears meaning to be exempt for the current year you must be the owner of record and your effective date of disability must be on or before 1231 of the previous year.

A 1 The first fifty thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment real estate property taxes when the person. South Carolina Estate Tax. It is often called the death tax for obvious reasons.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. In 2007 legislation was passed that completely exempts school operating taxes for all owner occupied legal residences that qualify under SC Code of Laws Section 12-43-220 c. The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled or legally blind.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. Deductions in South Carolina. What are the recent changes to South.

I has been a resident of this State for at least one year and. Most property tax exemptions are found in South Carolina Code Section 12-37-220. To qualify for the Homestead Exemption you must meet all of the following criteria.

Dependent exemption - as of tax year 2020 4260 can be deducted for each eligible dependent. The applicable South Carolina county will not prorate rollback taxes between purchasers and sellers. The South Carolina State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 South Carolina State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Starting in 2022 the exclusion amount will increase annually based on. When people relocate to the state they often wonder if there is an estate tax gift tax or. The federal gift tax kicks in for gifts of more than 15000 in 2021 and 16000 in 2022.

And special assessment real estate property taxes when the person. A Individuals estates and trusts are allowed a deduction from South Carolina taxable income equal to forty-four percent of net capital gain recognized in this State during a taxable year except for the portion of the capital gain that was recognized from the sale of gold silver platinum bullion or any combination of this bullion for which the deduction equals one. Military veterans or military personnel in South Carolina may be eligible for tax breaks in three general areas.

The South Carolina capital gains rate is 7 of the gain on the money collected at closing. South Carolina General Assembly 124th Session 2021-2022. The state of South Carolina has special provisions on property taxes for home owners who are 65 years of age or older and who have resided in the state for at least one year.

The assessment ratio on a second home owned by you is 6. SC Tax Structure State Deductions and Exemptions South Carolinas other major state deductions contribute to low tax burden June 2021 4 In addition to the standard deduction SC has other deductions and exemptions the largest of which are. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020.

The surviving spouse must be 50 years of age or older. The 1 Rule Step by Step Paul Sundin CPA August 23 2021. In South Carolina for a full calendar year you are eligible for a homestead exemption of 50000 from the value of your home.

Military retirees under the age of 65 can claim state tax deductions of up to 17500 of military retirement income for 2020. The South Carolina Department of Revenue is responsible. But this could be changing in the future.

South Carolina has seen a recent influx of new residents. The estate tax has been around for decades but it is evolved over time and the exemption has changed. The federal estate tax exemption is 117 million in 2021.

South Carolina General Assembly 124th Session 2021-2022. We streamlined the property tax exemption application process to. South Carolina has a capital gains tax on profits from real estate sales.

These benefits are usually available for a surviving spouse if the deceased spouse was 65 or older. However South Carolina also has a 44 exclusion from the capital gains flowing from the 1040 federal return effectively reducing the state tax to 392.

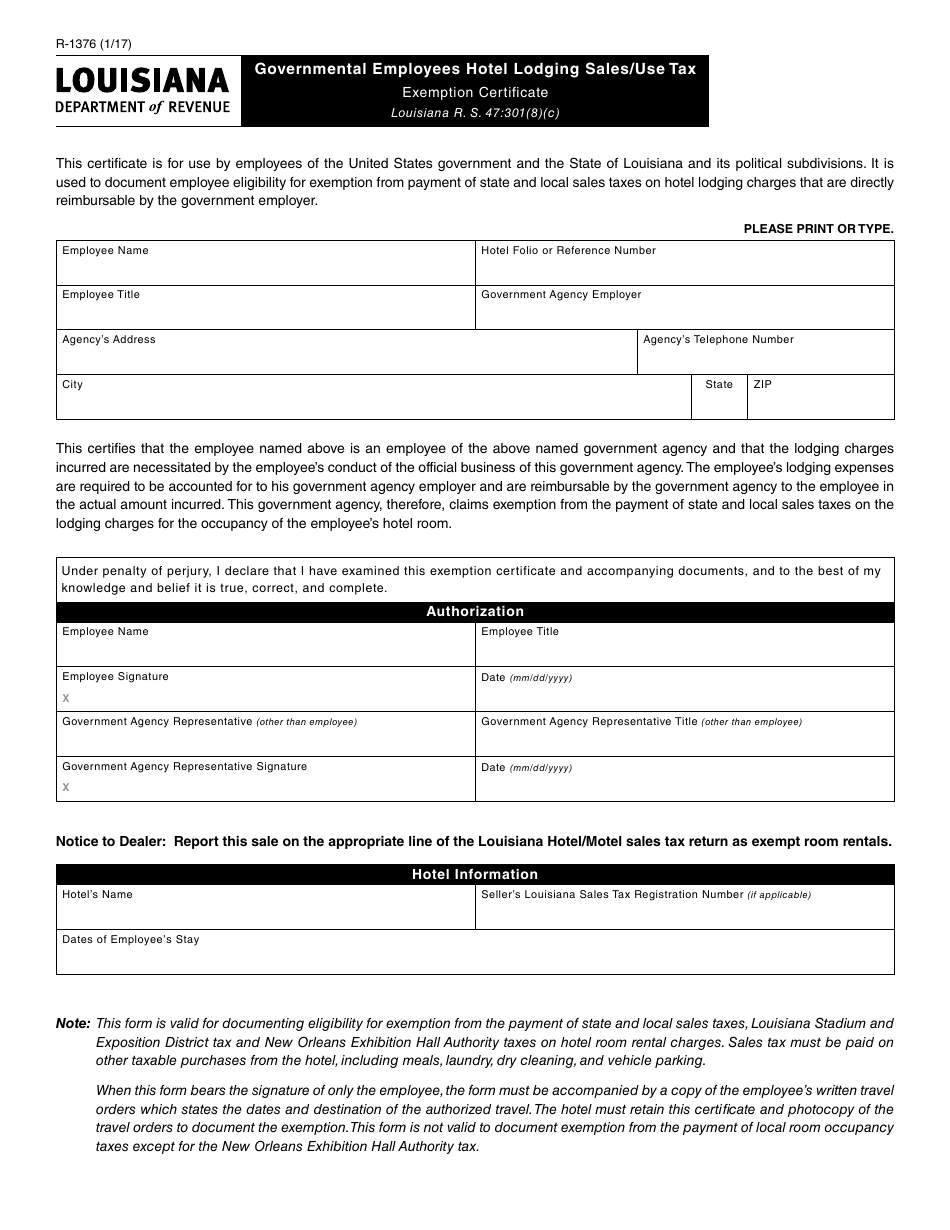

Form R 1376 Download Fillable Pdf Or Fill Online Governmental Employees Hotel Lodging Sales Use Tax Exemption Certificate Louisiana Templateroller

What Is A Homestead Exemption And How Does It Work Lendingtree

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Tax Relief For Homeowners Disability Rights North Carolina

How Do State Estate And Inheritance Taxes Work Tax Policy Center

South Carolina Estate Tax Everything You Need To Know Smartasset